If you don't feel like reading a long blog post today, here’s my most important advice: Don't spend more than you make.

But we all know that’s easier said than done. So I’ll walk you through how I follow this golden rule when it comes to running my business: TwoTone Creative.

I founded TwoTone just over 5 years ago. A few weeks after our launch, I read that 50 percent of small businesses fail within the first five years. Of the remaining 50 percent of those businesses, 80 percent fail by year 10.

I remember the gut-punch I felt reading that. After all, I don't have a degree in finance or business. I'm a graphic designer! I found myself wondering how, if all these other businesses fail so easily with way more experience than I have, what hope do I possibly have?

But instead of throwing in the towel right then, this statistic motivated me to seek out experienced advisors. I knew I needed help if I was going to succeed.

”Without counsel plans fail, but with many advisers they succeed.

Proverbs 15:22

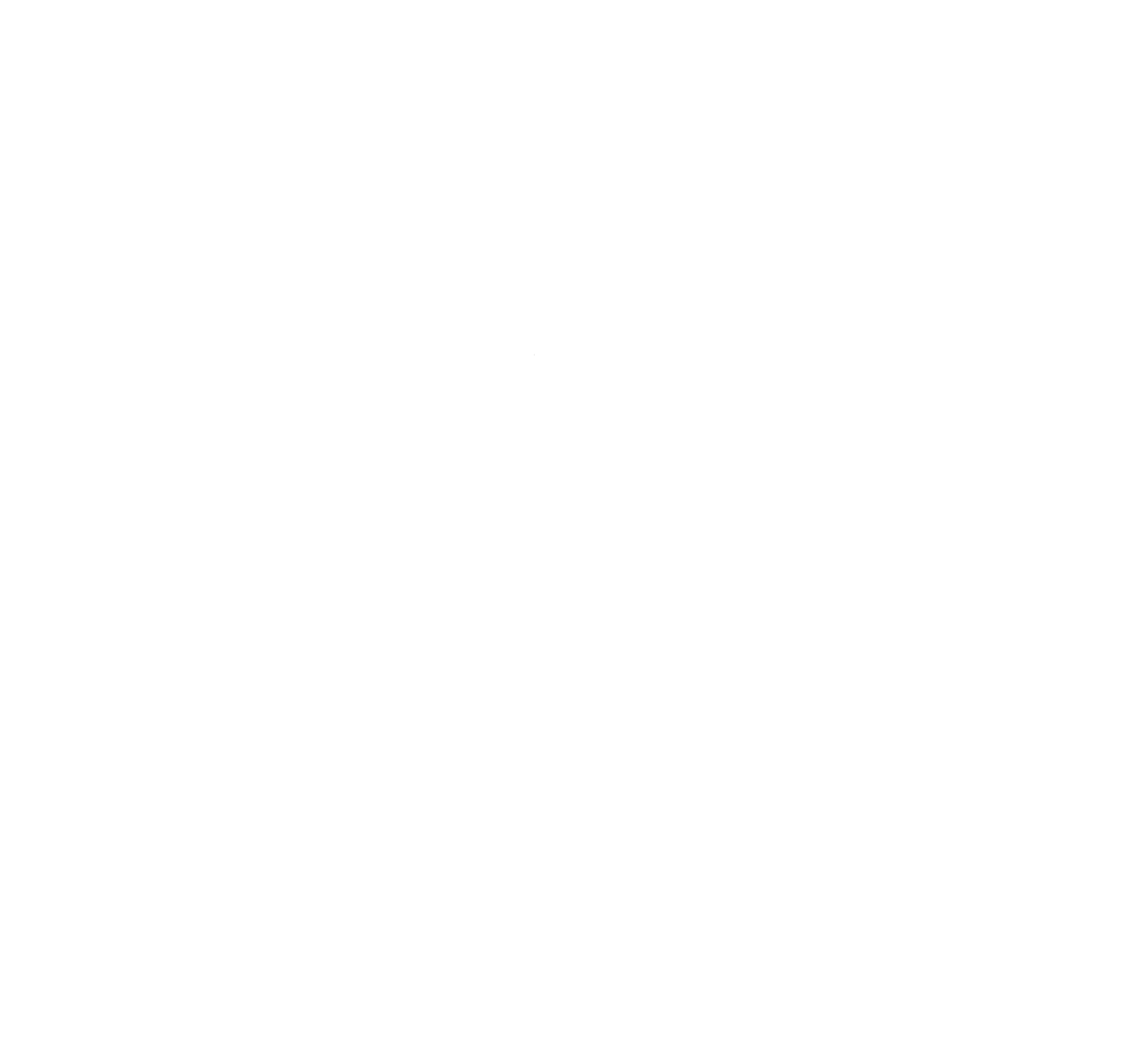

My husband and I had been listening to Dave Ramsey for about a year when I launched TwoTone.

We had used his methods and advice to become debt-free through a lot of hard work and discipline.

I treated TwoTone the same way. I didn't borrow any money to start my business (or keep it running), and I haven’t invested any personal money into it either. I let the company grow on its own, little by little.

These are the resources I used to build a financially healthy business model. I also sought out help and advice from many business friends, clients, and financial advisors.

The Dave Ramsey approach

I learned my finance essentials from Dave Ramsey. If you're completely unfamiliar with his work, read this overview of his baby steps. Do this step by step. If you don't make any adjustments to his plan or create loopholes for yourself, you'll be debt-free before you can say Sallie Mae or Freddie Mac.

If you're truly ready to commit to getting your finances under control, I would highly recommend signing up for Dave Ramsey's Financial Peace University. (You can often find his class offered locally, which provides accountability and is normally a bit cheaper than it is on Dave's site.)

Pro Tip

Listen to his daily podcast on your commute to work and you’ll be a Dave Ramsey expert in no time!

Entreleadership

For the business owner, Entreleadership is a must. This is my last Dave Ramsey plug. (No, he doesn't pay me to sing his praises!) This is Dave’s step-by-step playbook on taking your business to the next level. I learned a lot about what it means to be a leader, rather than just a boss or task delegator.

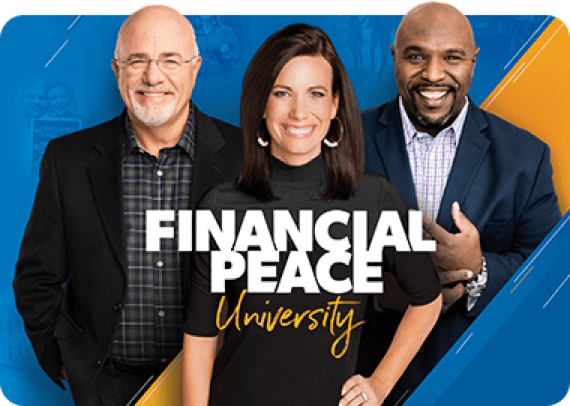

Profit First

Mike Michalowicz is a smart guy. He is also hilarious. He wrote a book called The Pumpkin Plan, which eventually led me to Profit First, which eventually led me to read Run Like Clockwork. I found all of these books to be both practical and insightful, but I will focus on the financial aspects I gleaned from Profit First here.

The high-level overview is that you create several separate bank accounts, as follows:

- Income (This is where you deposit any income, that's it!)

- Expenses (This is where all money is pulled from, including payroll and contractors)

- Owner Compensation (This is where the money you make goes)

- Taxes (This is the government's money)

- Profit (This is where you actually make a profit!)

The key here is that you set a percentage for each category. Potentially that might look like this:

- 60 percent Expenses (This is where all money is pulled from)

- 20 percent Owner Compensation (This is where the money the business owner makes goes)

- 15 percent Taxes (This is the government's money)

- 5 percent Profit (This is where you actually make a profit!)

Now I set mine up a bit differently since TwoTone Creative is an S-Corp.

This means I'm on the payroll as an employee, so instead of Owner Compensation, I have an account called Payroll, but I still have an expense account as well. Your expenses may differ vastly from the above, but this is a good starting point.

Here are the six account categories I use:

- Profit

- Income

- Expenses

- Payroll

- Taxes

- Vault

Over time, you work to lower expenses and raise the profit - but only by 1% per quarter. Slow and steady.

You'll want to read the book to get the full picture and the why of it (or listen to it on audible for a great laugh — Mike is amazing to listen to!)

Two times a month (on the 10th and 25th), I move money from the income account into the four other accounts (excluding savings). This means, at any given day, I can log into my bank account and know how we are doing.

Do we have enough for quarterly taxes? Check.

Do I have enough to cover payroll? Check.

Do I have enough to cover my lease? Check.

It's an awesome system that ensures business health and growth. I love talking about this stuff, so feel free to get in touch if you want to know more about a particular topic.

I also hired an amazing Profit First business coach that holds me accountable to my profit and finance goals. Check out her website if you want to know more about working with a business coach.

And … that’s it. I hope this window into my growing business will help you be your best in whatever you are out there doing. Are there any tools, resources, or books you rely on to run your business with rock-solid financial footing? I’d love to hear about them! Comment below to share them or get in touch to chat.

With more than 10 years of agency experience, Jenny has had the privilege of working with a large variety of brands. She loves partnering with other business owners and entrepreneurs, and specializes in brand development. From digital marketing to online course creation, Jenny’s knowledge and skillset has prepared her to be a successful creative director.